Clients in the MEM

Successful results – Clients in the MEM.

One of the main activities within the scope of Plan 360 Management is Energy Procurement.

The proper execution of a supply agreement as well as the successful performance of the contracted products require thorough work, a proactive approach, and the capacity to adapt.

Prior to executing a supply agreement, companies should have a strategy in place and the proper understanding of the product to be contracted. Enerlogix assists its clients in understanding the different options available and assess the possible risks of each offer.

Sometimes after the execution of the supply agreement, commodities/energy prices change affecting the performance of the contracted products. Other times, companies may need to review their energy consumption and look for ways to mitigate risk and protect their budgets.

As part of our Plan 360 services, Enerlogix monitors the performance of each of its clients and takes a proactive approach in identifying the cause of what may be affecting the performance and savings of each load center and assess a viable solution.

The following are examples of some of our clients who have achieved successful results in the MEM.

Case 1 – Mining Company

This load center, located in the North distribution region, is connected to 115kV which is considered a sub-transmission user. Its annual consumption is around 130 GWh with an 80% Load Factor.

The contracted product allows the user to modify the nominated hourly consumption one week in advance and provides a specific tolerance band. When consumption patterns are stable, the product has a medium-to-low propensity to risk. The product is subject to inflationary adjustments (Energy, Capacity and Clean Energy Certificates (CELs)) avoiding the risk for SPOT market transactions.

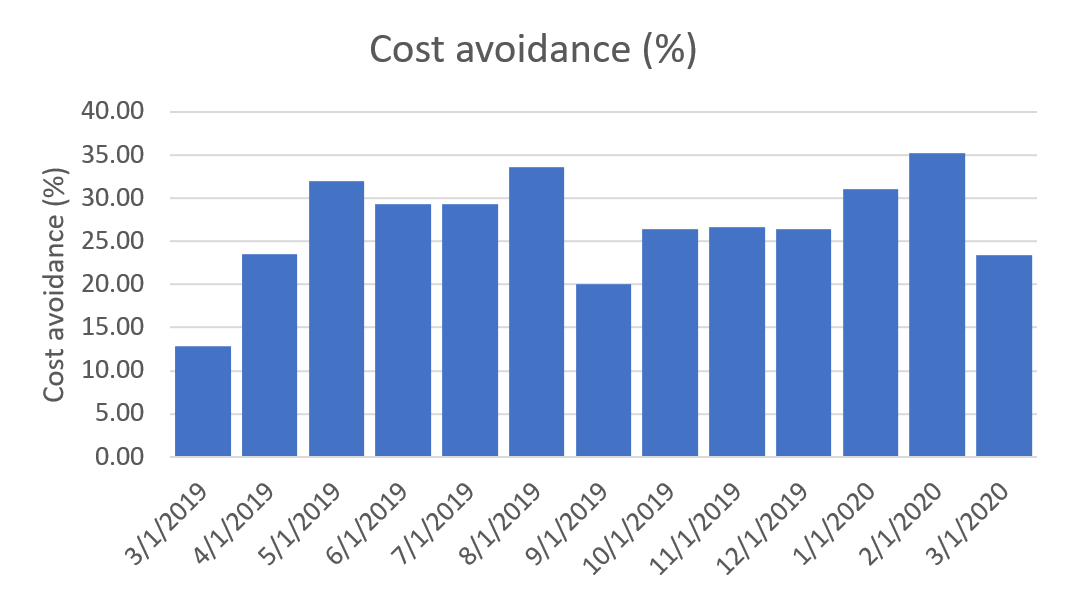

This client managed to save up to 23% when compared to its corresponding basic service rates month by month. The estimated rate during this timeframe was $1,481 MXN/MWh.

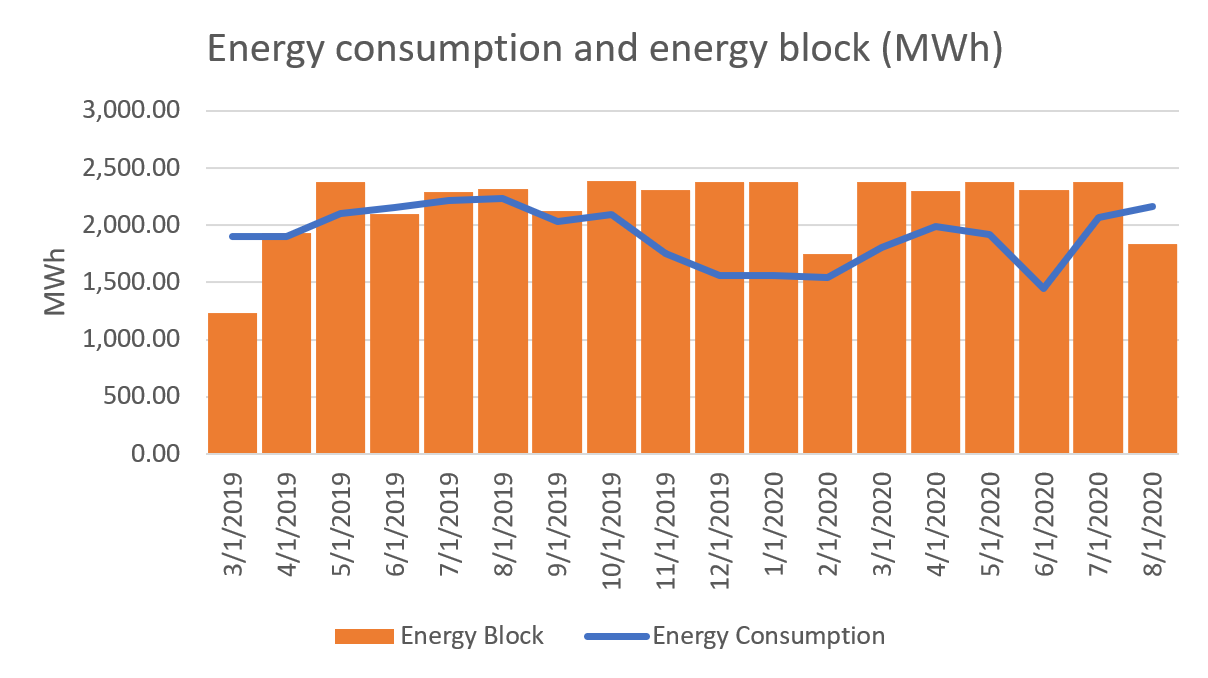

Case 2 – Medical Devices Manufacturer

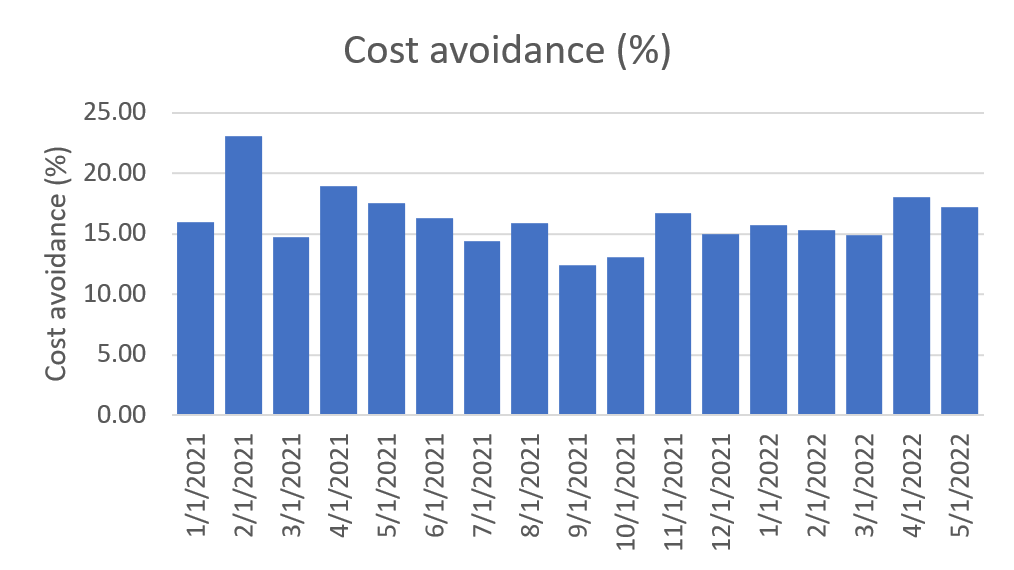

This load center, located in CFE’s North-Gulf Division, has an annual consumption around 2,000 MWh. Due to its variability in monthly consumption, its Load Factor is 60%.

This load center, which does not exceed 1MW of demand, has delivered total savings of $1,986,061 MXN ($99,303 USD) estimated around 25%. In fact, throughout the life of the contract, monthly savings of up to 31.18% were achieved when comparing the supplier’s rate against basic service.

Under its supply agreement, the user can set its expected energy consumption monthly. This allows for better control over the expected rate risk. Energy price per MWh varies no more than 2% which contributes to better budget certainty. Given the variability in monthly consumption, this product is considered low risk.

Case 3 – Appliance Motors Manufacturer

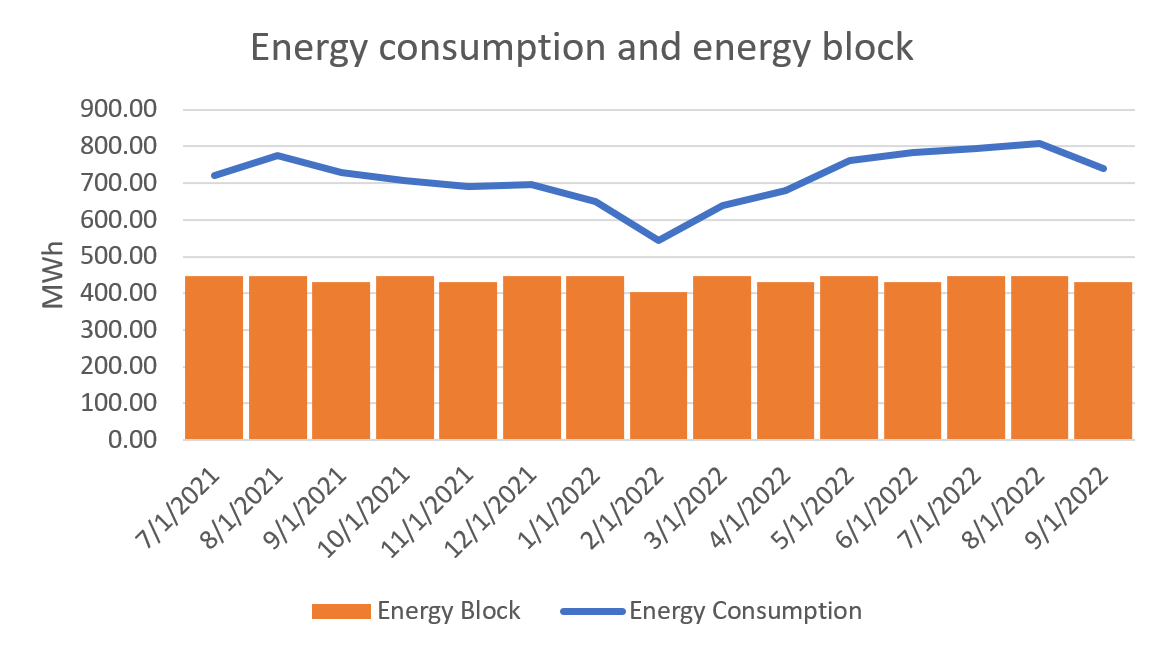

This is facility, located in north-eastern Mexico and is connected to high-tension (115kV). It has an annual consumption of 23,000 MWh and a Load Factor of 75%.

This client contracted a Heat Rate product. Due to the elevated risk associated to natural gas market prices, these types of products must be managed via financial hedges. Enerlogix assisted the client in determining and fixing its energy and capacity blocks, enabling it to determine the spot market exposure and its appetite for risk.

In one year, this load center achieved savings of $8.8 million MXN ($440 thousand USD) equivalent to 21% savings against CFE’s Basic Service Supply.

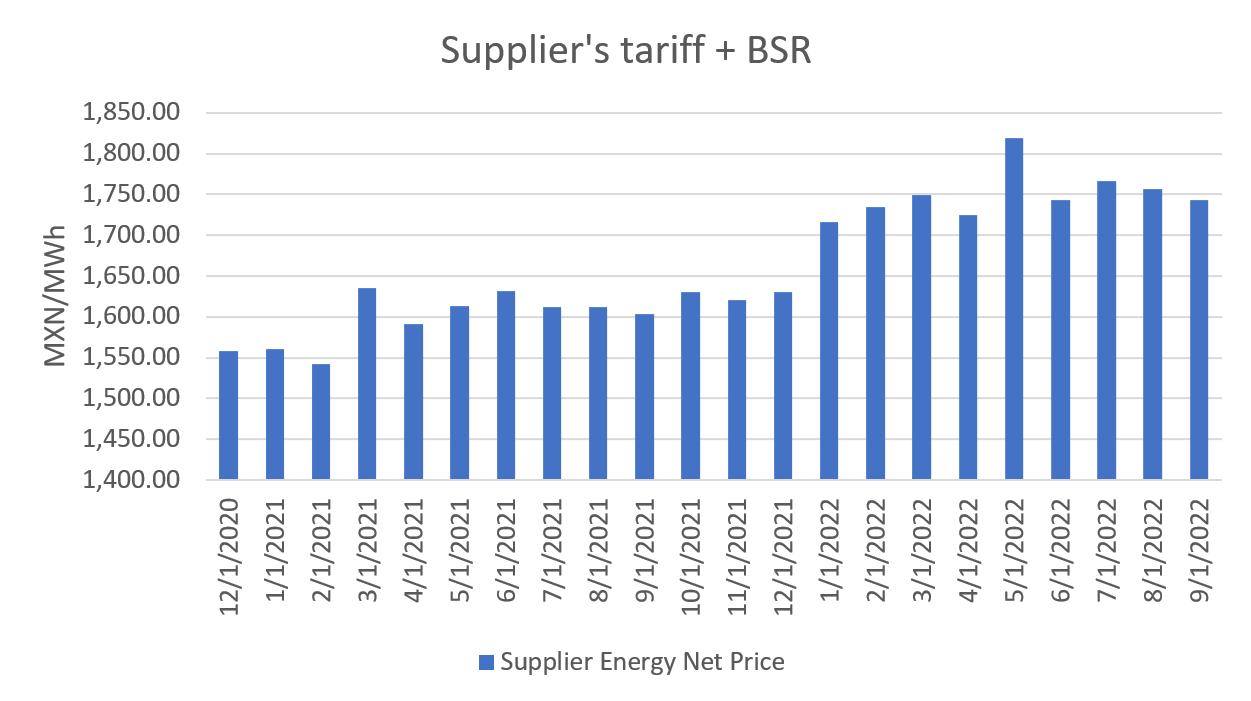

Case 4 – Appliances Manufacturer

This facility is located in the North-Gulf region and is connected to high-tension. Its current annual consumption is 33,000 MWh. Its Load Factor is around 65%.

This client contracted a Heat-Rate product, which as mentioned on the previous case is an elevated-risk product. However, Natural Gas prices were very competitive, and the client took advantage of this opportunity. During the contracted term, the supplier’s weighted tariff for the client was $1,383 MXN/MWh, delivering savings around 27%. This translates to around $17 million MXN, equivalent to $850,000 dollars.

Case 5 – Electronic Instruments Manufacturer

This load center, located in CFE Distribution’s North-Gulf Division, has an annual consumption of 9,000 MWh and an 80% Load Factor.

This facility secured a low-risk supply agreement in which the contracted products (Energy, Capacity and CELs) are inflation-free. The retailer products costs are truly fixed for the life of the contract with no adjustments of any kind, delivering budget certainty. Given the characteristics of the load center’s energy consumption pattern, the client opted for an aggressive market strategy where 35-40% of its energy is purchased from the spot market. Following this strategy, the client was able to reach savings up to 34%. For the year, the electricity rate was estimated at $1,619 MXN/MWh resulting in $3.5 million MXN ($174,000 dollars) in savings, equivalent to 19% vs CFE’s Basic Service.